12 Apr Phocuswright Report: The Critical Role of Independent Distribution in the U.S. Travel Industry

Foreword

How do you put a value on consumers’ ability to comparison shop? What does it mean for travel consumers looking for the best deals on flights, accommodations and car rentals? In travel, choice brings the ability to find the best options and prices, and choice brings value. Today, travel has never been more accessible. This is largely due to travel technology companies that foster transparency, choice and innovation for both consumers and travel suppliers. Without travel technology and independent distribution, consumers would never know the full range of options they have for travel, and travel suppliers would not have the same global reach. Effective comparison shopping would be impossible and finding deals on travel would be a challenge. Travelers benefit from access to convenient, efficient and elegantly designed platforms that help them to conveniently shop and book the travel options that suit their needs. At the same time, suppliers prosper by gaining access to millions of consumers around the world who choose to shop for travel. When travel suppliers have to compete for customers based on price, services and options, consumers win.

Online travel agencies (OTA), metasearch platforms (metas), travel management companies (TMCs), and global distribution systems (GDSs) are the key stewards of the travel marketplace. Without them, comparison shopping would be cumbersome, if not impossible, as consumers would never know all of their options. With hundreds of commercial airlines and millions of accommodations options globally, OTAs, metas, TMCs and GDSs democratize travel and give consumers the power to search, compare and book the itinerary that is best for them. For suppliers, these independent distributors provide access to millions of travel consumers globally who choose to search, compare and book travel via third-party intermediaries.

Providing comparison shopping, promoting competition, leveraging technology and ensuring that consumers and travel agents have access to travel products and services are the hallmarks of independent distribution. Powered by technology developed and deployed by GDSs, OTAs, metas and TMCs have access to the tools and information they need to give travelers an efficient shopping and booking experience. Additionally, travel providers can offer their products and services to consumers beyond their local markets, thereby extending their reach.

Independent distribution is paramount to supporting and growing a travel economy that is affordable and accessible to travelers worldwide. This important analysis performed by Phocuswright highlights the value of the independent distribution of travel for both consumers and suppliers. Today’s travel and tourism economy operates because of the access, competitive environment and reach facilitated by independent distributors. Their technology, innovations and marketing expertise continue to foster economic growth for travel and tourism, and provide consumers with the competitive shopping experience they deserve.

Steve Shur

President

The Travel Technology Association

Executive Summary

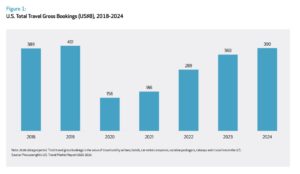

The U.S. travel sector has been badly affected by the COVID-19 crisis, although there are encouraging signs of a rapid recovery. Having fallen 61% to just US$156 billion in 2020, gross revenue is rallying and is expected to grow to $289 billion in 2022, with full recovery to 2019 levels by 2025.

Online travel intermediaries are playing a key role in this recovery. Even in the best of times, planning travel is complex. With post-pandemic travelers seeking out more information to reassure themselves about safety, online travel intermediaries play a critical role in reigniting the return to travel. They are particularly important during the inspiration and shopping stages of the customer journey. By creating an environment where travelers can easily compare product features and shop prices, they foster a competitive landscape where suppliers must battle to capture the traveler’s business.

Although the dividing line is becoming increasingly blurred, online travel intermediaries can be broadly classified into online travel agencies (OTAs) and metasearch services catering to the leisure/unmanaged market, and travel management companies (TMCs) serving business travel. Global distribution systems (GDSs) are also part of this ecosystem, acting as enablers for the intermediaries. In all cases, the continued value of indirect distribution for both customers and suppliers has been demonstrated by its resilience; in 2020 intermediaries delivered over one third (36%) of travel industry gross revenue in a very challenging business environment. In addition, there is considerable evidence that travel intermediaries frequently drive supplemental direct sales, positioning suppliers in front of customers who subsequently book through direct channels.

From the consumer perspective, online travel intermediaries play a pivotal role in the travel distribution process. They add value by aggregating disparate supply from multiple competing brands, helping consumers navigate the myriad options available, as well as facilitating the eventual booking process. Consumers particularly value online travel intermediaries for their ability to reduce friction by facilitating the easy comparison of multiple, multi-brand options and prices in a single location; for their provision of objective, unbiased information (particularly user reviews) to aid decision- making; and for their superior user and one-stop-shop booking experiences. This is especially true when supply is fragmented. With consolidated options available in a single integrated hub, consumers feel that online travel intermediaries make it easier to find, and subsequently book, the travel option most appropriate for them. Such increased transparency may also lead to lower prices, with “offers the best price” being the benefit of booking through OTA channels that consumers cite most frequently.

Travel suppliers value online travel intermediaries in their traditional role as trusted distribution partners. Although most suppliers prioritize direct bookings, they also recognize that they cannot service every opportunity in a cost-effective manner if they work in isolation. Smaller players, often lacking the brand power, technology and resources to drive sufficient business through direct channels, identify the reach, visibility and additional bookings they gain from working with third-party intermediaries as highly beneficial. Most suppliers acknowledge that working with the right portfolio of online travel intermediaries on a pay-per-performance basis allows them to position themselves in front of a wider audience quickly, easily and more cost effectively than they could otherwise do independently.

In addition to their distribution role, online travel intermediaries are also viewed as important technology partners by travel suppliers. Post COVID-19, few suppliers will have the budgets, in-house technical expertise or other resources to keep pace with technology developments and ever-expanding customer expectations. To counteract this, many are turning toward online travel intermediaries, which are increasingly perceived as specialist solution providers with technology as their core competency. They can provide suppliers with the functionality needed to supplement suppliers’ existing systems and explore emerging opportunities. This represents a considerable evolution in the oft-confrontational relationship between suppliers and online travel intermediaries, with the latter increasingly seen as trusted partners/vendors that can deliver multiple streams of value to pressured travel suppliers.

Research Highlights

- Gross revenue for the U.S. travel sector fell 61% to just $156 billion in 2020 as the COVID-19 pandemic impacted the sector. However, a rapid recovery is underway, and gross revenue is expected to grow to $289 billion in 2022 with a full recovery expected by 2025.

- Online travel intermediaries, including online travel agencies (OTAs), metasearch services and travel management companies (TMCs) (supported mainly by GDS technology) represent a significant source of indirect business for most travel suppliers, and delivered over one third of overall industry gross revenue in 2020.

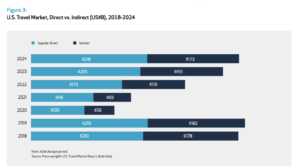

- Indirect distribution, at $182 billion, accounted for just over 45% of the total travel sector in 2019, falling to 36% in 2020 as consumers turned to direct channels during the pandemic. However, indirect channel distribution is expected to return to pre-pandemic levels by 2024.

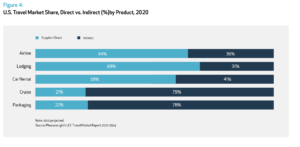

- Consolidated segments such as flights had a higher share of direct revenue than fragmented segments or those requiring deep product knowledge. Approximately two thirds of flight revenue in 2020 was transacted through direct channels compared to just a fifth for cruise and packages.

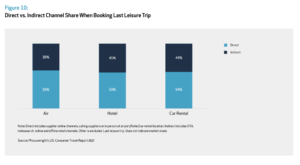

- Travelers value online travel intermediaries for their ability to reduce friction by facilitating the easy comparison and booking of multiple, multi-brand options in a single location. In turn, online travel intermediaries feature prominently in both the inspiration and shopping stages for travelers, with 39%, 45% and 44% of consumers using indirect channels to make their last leisure air, hotel and car rental bookings respectively.

- Travel suppliers increasingly value the continuing role of online travel intermediaries in supplementing their direct distribution efforts in a cost-effective manner. Smaller suppliers, in particular, value the reach, visibility and additional bookings they can gain from working with the right online travel intermediaries. And all suppliers, large and small, recognize the significant benefits of online travel intermediaries’ pay-per-performance business model for driving supplemental revenue.

- Suppliers’ perceptions of the role of online travel intermediaries have also broadened significantly, with the latter no longer seen as solely distribution partners but as strategic technology providers. With resources stretched by the COVID-19 crisis, suppliers are partnering with online travel intermediaries, whose core competency is distribution technology, to provide them with the required functionality in a cost-effective and timely manner.

Objectives and Methodology

Objectives

Phocuswright undertook this research to understand the role that online travel intermediaries play in contributing to the success of the U.S. travel sector. In particular, the value added by working with these facilitating companies is assessed qualitatively and quantitatively from both the consumer and the supplier perspectives. Key trends that may disrupt these symbiotic relationships are also identified and assessed.

Methodology

To gain a comprehensive understanding of the role and importance of online travel intermediaries within the U.S. travel distribution landscape, Phocuswright adopted a mixed methods approach.

First, we conducted a series of in-depth interviews with senior executives of key U.S. travel suppliers. These included airlines, hotels (branded and independent), car rental, vacation rental, corporate housing providers and tour operators. Both large and small players were included to solicit a variety of views and perspectives. Content analysis techniques were used to identify common themes and examine the perceptions of U.S. travel suppliers as to the advantages and challenges of working with online travel intermediaries.

Interviews were structured to investigate how suppliers view and work with online travel intermediaries, as well as establish the opportunities, challenges and perceived value of such relationships. The questions focused on three main themes: identifying the portfolio of relevant partners with whom the company worked in the sales, marketing and distribution arenas; understanding the degree to which, and the motivation behind, travel companies’ decisions to outsource certain aspects of their sales, marketing and distribution; and obtaining insights about relevant current developments and future possibilities and their potential impacts on the travel sector.

Consumer data cited in the report was drawn primarily from a series of complementary Phocuswright studies. These include: U.S. Consumer Travel Report 2020, U.S. Corporate Travel Report 2020-2024, The New Global Traveler: Discovering the Impact of Technology 2019, U.S. Online Travel Agencies 2019: Key Developments; and the COVID-19: Path to Recovery series of reports. Market sizing data and leisure/ unmanaged travel metrics were drawn from the U.S. Travel Market Report 2020-2024.

Phocuswright also conducted extensive desk research based on available published data for airlines, OTAs, traditional travel agencies, TMCs, online booking tools (OBTs), corporate buyers, aggregators, IT providers, industry organizations and governmental bodies to complement our proprietary data. All sources are noted on the relevant figures.

Introduction

COVID-19 has had an unprecedented impact on the travel and tourism sector. Lockdowns, closed borders, grounded flights and shuttered hotels devastated travel globally. With vaccines now available to all U.S. adults, and consumer confidence growing, there are encouraging signs of an uptick, particularly in domestic leisure travel. This may, however, be tempered by continuing fears about new, more infectious strains of the virus, pushing a meaningful recovery into 2022 and beyond.

Distribution, and particularly digital distribution, will play a key role in this recovery. Planning travel is a challenge for consumers, even in the best of times. The travel sector is composed of a complex ecosystem of suppliers, aggregators and online agents, all competing and cooperating with each other. As a result, customers need to sift through an array of options to find the product or service that is right for them. With the consequences of a suboptimal choice in mind, travelers seek out detailed, relevant, and topical information to help them minimize risk and make the right selection. The increased risk due to COVID-19 pushes consumers to source even more depth and variety of information to make the right decision.

Travel information has traditionally been accessible in two ways: 1) directly from suppliers by phone, in person or over the internet or 2) through third parties known as intermediaries, such as travel agencies, tour operators, TMCs or OTAs. In both cases, technology-based systems have become deeply ingrained in the distribution process, resulting in a complex interconnected network of digital-based channels linking suppliers and customers. These systems guide travelers through confusing terrain to connect them with the products and services most appropriate to their needs, while at the same time positioning suppliers in front of a relevant, qualified audience. Technology’s role has exploded due to internet-based and mobile ecommerce, to the point where most travel segments have become deeply dependent on online systems for marketing, distribution, and even day-to-day operations.

Given their prominence, this paper sets out to examine the role and contribution of online travel intermediaries from both a consumer and supplier perspective. Distribution is defined broadly, incorporating elements of sales, marketing, retailing, merchandising and loyalty – in other words all the phases of the customer journey for today’s digital traveler. In particular, the value added by working with such systems is assessed both qualitatively and quantitatively to help demonstrate the net benefit of these key players for consumers and suppliers alike.

U.S. Travel Marketplace Overview

Market Size

To assess the importance of online travel intermediaries for the U.S. travel sector, we first need to understand the overall size of the market.1 2019 was a strong year for travel. More Americans were travelling than ever before: consumers took more, and longer trips, and were more likely to travel abroad. Travel was the top discretionary spending priority, surpassing dining/nightlife, home improvements and consumer electronics. Although the grounding of the 737-MAX aircraft and economic/political uncertainty surrounding the 2020 presidential election were challenges, the market in the U.S. expanded 3% to $401 billion in 2019.

While similar growth rates had been forecast for 2020 and beyond, travel restrictions and stay-at-home orders resulting from the global COVID-19 pandemic meant that the market size fell 61% to just $156 billion in 2020 (see Figure 1). With many companies forced to restrict travel and relying more heavily on online meeting tools, corporate travel was hit harder than the leisure sector. While business travelers only make up around 10% of passengers, they account for the majority of revenue and profits for airlines, hotels and car rental companies, as they are more likely to book premium products and/or purchase at the last minute. Phocuswright’s U.S. Corporate Travel Report 2020-2024 estimates that corporate travel revenue fell a steep 71% to $39 billion in 2020 compared to the previous year. The meetings and events space was hit even harder, with over 95% of events either cancelled or postponed.

Opinions are divided as to the pace of recovery. Although a comprehensive vaccination program is well underway in the U.S. and travel will undoubtedly benefit from the government’s $1.9 trillion coronavirus relief effort, the travel sector is still a long way from being out of the woods. Domestic leisure travel restarted in the spring but international borders have only recently reopened. The resumption of business travel, while slower than leisure, will also provide some momentum. In general, most analysts agree that the recovery will be gradual, with revenue not expected to return to 2019 levels until 2025. However, as evidenced during the summer, pent-up demand for travel is strong and may drive a swifter recovery once restrictions are eased.

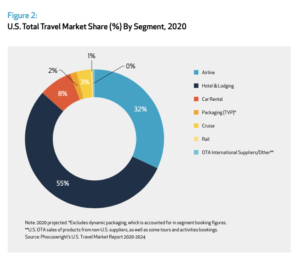

The COVID-19 pandemic has prompted structural changes in the U.S. travel sector. Given the widespread restrictions on travel, lodging increased its share of the U.S. market considerably in 2020, growing to 55% of gross revenue (see Figure 2). However, with high fixed costs, occupancies at record lows and business travelers still noticeably absent, many hotels continue to suffer financially. In contrast to hotels, vacation rentals have experienced a strong resurgence, with city dwellers, no longer tied to the office, seeking getaway alternatives – whether in the mountains, beach, suburbs or countryside. Short-term vacation rental companies such as Airbnb are benefiting from this trend.

The airline segment was virtually eviscerated in 2020, plummeting 69% to just 32% of overall gross bookings in 2020, although government support has helped bail out the industry. Car rental, representing a theoretically safer form of transport during the pandemic, was less heavily hit (shrinking 40%) and is expected to recover more rapidly as leisure travel picks up in step with vaccinations. Finally, the cruise and packaged travel segments, both high-ticket-per-customer segments, have been impacted most significantly (-78% and -83% respectively). With their primarily international focus as well as multi-traveler nature, recovery will be more challenging unless companies can reorientate themselves in the short run.

Direct vs. Indirect Distribution

Given the complexity of organizing travel and the challenges associated with matching supply and demand, indirect sales play a pivotal role in most suppliers’ sales, marketing and distribution processes. Online travel intermediaries – OTAs and TMCs – aggregate disparate supply, helping consumers navigate the available options as well as facilitating the booking process, serving as a key driver of sales. Although the dividing line is becoming increasingly blurred, two different forms of online travel intermediaries play critical roles within the distribution process.

Within leisure and unmanaged business travel, OTAs, which source their content and inventory from GDSs, aggregators and direct connections with suppliers, are an important source of revenue for most travel suppliers. OTA gross revenue grew from less than $36 billion in 2009 to more than $79 billion in 2019, falling back to $32 billion in 2020. Despite this steep drop, OTAs accounted for 21% of total travel revenue in the U.S. during the 2020 crisis. In addition, OTAs also play an influencer role when travelers shop on their platforms but subsequently book directly with a supplier. Research has shown that OTAs act as a complement to direct sales, positioning suppliers in front of potential customers and giving the latter a choice in how to complete the subsequent transaction.

Within the U.S., the leading OTAs are challenged by a diverse and substantial long tail portfolio of smaller companies; they mostly compete using a niche specialization or by targeting specialized markets. As consumers’ information needs become more specific, this specialization is growing in importance and popularity, with a recent SiteMinder study noting the increased prominence of specialized OTAs in its annual online hotel distribution analysis. Other third-party players, notably vacation rental giant Airbnb and search platform Google, are digging deeper into the leisure travel space, increasing choice for both customers and suppliers. With reinforced resources following its 2020 IPO, many perceive Airbnb as having major potential to disrupt existing leisure and corporate travel relationships to become the third mainstream travel platform in the U.S. market. While it has primarily limited its efforts to the lodging and experiences segments, the newly invigorated company may broaden its travel offerings. Airbnb could move to more effectively monetize its loyal and travel- oriented online audience.

Travel intermediaries also play a key role in the corporate travel segment. Here, bookings are facilitated by professional TMCs, which also add value by helping companies better manage their travel function. Bookings typically flow through channels such as the GDS and/or the developing NDC standard rather than the internet, and are thus not typically reported in “online” travel gross revenue metrics. Badly affected by travel restrictions during the COVID-19 crisis, gross revenue for TMCs and other corporate travel intermediaries fell 77% to $26 billion in 2020. Recovery is expected to be slower than leisure, with the corporate segment not returning to 2019 volumes before 2025 at the earliest.

Combining both segments allows us to quantify the relative importance of travel intermediaries for the U.S. travel sector. Intermediaries drove $182 billion in gross revenue on behalf of travel suppliers in the U.S. marketplace in 2019 (see Figure 3). Although their joint contribution fell significantly in 2020 to just $56 billion, online travel intermediaries are expected to play a critical role in the rebound. In a complex and risky travel environment, consumers will likely return to these trusted platforms to help with their planning and shopping processes. As a result, the contribution of travel intermediaries is expected to nearly return to 2019 levels by 2024 though corporate travel intermediaries, as noted earlier, are expected to be slower to recover.

Within segments, direct sales correlate strongly with fragmentation (see Figure 4). In consolidated segments such as airline and lodging, companies can leverage their brand power, marketing expertise and financial resources to more successfully drive direct bookings. In contrast, more fragmented segments requiring expert knowledge, like cruise for instance, typically rely more on third parties such as OTAs or corporate travel agents for their online bookings.

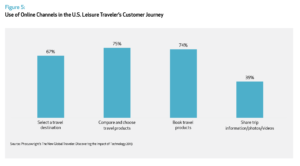

The Consumer Perspective

As discussed, the explosion in digital adoption over the past decade has dramatically reshaped how consumers engage with the travel sector. Digital resources have become deeply ingrained into travelers’ lifestyles and shopping behaviors, especially with many physical businesses closed during the COVID-19 crisis. More than ever, consumers turned to digital channels for their day-to-day shopping and information needs. Thus, it’s not surprising that the majority make extensive use of digital channels throughout their travel inspiration, shopping and booking processes (see Figure 5).

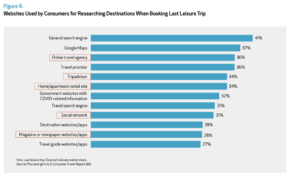

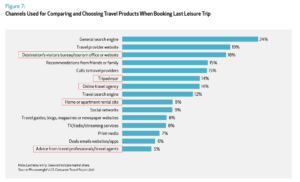

Online travel intermediaries, including TMCs, feature prominently in both the inspiration (see Figure 6) and the shopping stages (see Figure 7), highlighting their importance in the travel consumer decision-making process. By creating an environment where travelers can seamlessly compare product features and shop prices, they foster a highly competitive landscape in which suppliers must battle it out to capture the traveler’s potential business.

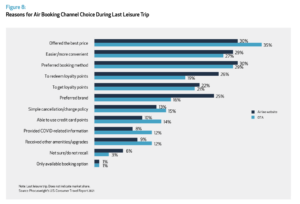

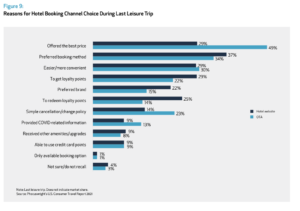

Consumers cite a variety of reasons for using online travel intermediaries, including gaining access to the best prices and facilitation of the somewhat complicated booking process (see Figures 8 and 9). Consumers also underscore the ease of changing or cancelling a booking as well as the COVID-related information that online intermediaries provide. These benefits help reduce friction for consumers, allowing them to identify and book the most appropriate products and services for their needs more easily.

As a result, travel intermediaries are widely used by U.S. travelers (see Figure 10) and play a more significant role in less consolidated segments like hotel and car rental. With supply aggregated into a single integrated hub, consumers feel that online travel intermediaries make finding and booking travel products easier. These third parties can neatly display the most appropriate products and services for an individual’s needs at the best available price, in addition to providing a superior user experience.

Online travel intermediaries, especially the TMCs, are also highly valued within the corporate travel sector. In this segment, it is the company, rather than the individual traveler, that is the customer. And with travel typically representing a company’s second largest expense, most organizations have a strong motivation to better manage their travel activities and expenditures. Corporate-focused intermediaries help aggregate and surface relevant choices like negotiated rates for business travelers within the bounds of a company’s travel policy. Beyond controlling costs, these intermediaries also provide services such as employee tracking to help companies fulfill their duty of care obligations, invoicing and reconciliation. Many are looking at further integrations. Similar to how leisure travelers value OTAs, business travelers also appreciate the technology (website/app functionality) and upgraded user experience offered by a corporate intermediary, in addition to offline services through the TMC channel.

In summary, online travel intermediaries are likely to become even more important within the travel sector post COVID-19. Digital-savvy consumers familiar with the utility and convenience of shopping and booking travel through online channels are driving this trend. Technology continues evolving, with media such as messaging, voice search and even virtual reality taking on increased significance, albeit still very much at the experimental stage. However, already stretched by the COVID-19 crisis, few travel suppliers have the budgets, technical expertise or resources available in-house to keep pace with developments, let alone explore new possibilities. Accordingly, many are turning toward partnerships with online travel intermediaries, both to supplement the functionality of their existing systems and explore innovative new technologies.

The Travel Supplier’s Perspective

Developments in technology have also prompted change on the supplier side, with digital becoming integrated into almost every aspect of the travel value chain. Digital continues to have a transformational effect on the sector, helping to improve customer service, reduce costs, increase revenue per customer and improve overall efficiency. However, the rapid pace of change, not only in terms of the technology itself but also consumer expectations, represents a challenge for most travel suppliers. And with the pandemic having accelerated consumers’ usage of, and expectations from, digital tools, suppliers must take decisive action to address this transformation.

With resources severely curtailed by the slowdown in business, few suppliers, regardless of size, have the budgets, technical resources, or expertise to keep pace. But in today’s highly competitive marketplace, some companies that are unable or unwilling to adapt will quickly fall by the wayside. Consequently, many are turning to online travel intermediaries to fill these gaps. They supplement or, in some cases, replace mission critical capabilities in their sales, marketing, distribution and loyalty areas.

To gain a better understanding of suppliers’ motivations and perceptions around working with travel intermediary partners, Phocuswright conducted a series of in-depth interviews with senior executives of key U.S. travel suppliers in early 2021. These included representatives of airlines, hotels (branded and independent), car rental, vacation rental, corporate housing providers and tour operators. Respondents highlighted a series of key benefits from partnering with travel intermediaries rather than developing the equivalent functionality in-house. These included:

Access to consumer segments

Though most prioritize direct bookings, U.S. travel suppliers also make extensive use of a diverse portfolio of online travel intermediaries to facilitate access to specific segments. Many work with the GDSs to service the valuable corporate travel market, as well as leverage OTA platforms to make themselves available to customers in foreign countries or with niche interests. Smaller suppliers lack the brand power, technology and other resources to be able to drive sufficient business through their direct channels. They deeply value the reach, visibility and additional bookings they gain from working with third-party intermediaries. And for suppliers of all sizes, working with the right online travel intermediaries positions them in front of a wider audience more quickly, more easily and more cost effectively than if they worked independently.

Resource availability and augmentation

Most travel suppliers were forced to slim down to bare bones during COVID-19 by furloughing staff, freezing projects and focusing on survival. As a result, capital, cash flow and expertise are at an all-time low. The business environment, however, has become more complicated, competition more intense, and consumers more demanding. Needing to do more with less, and sooner rather than later, suppliers must act quickly in a changed marketplace to regain their competitive position and take advantage of the recovery. Though they might prefer a DIY approach, working with online travel intermediaries is increasingly seen as a way of developing solutions to their time-sensitive needs. Since these technology-focused companies typically utilize the latest protocols, platforms and processes, partnering in this way allows suppliers to avoid missing the recovery boat because of a lack of internal resources and capabilities.

Technology leadership

While travel stagnated during COVID-19, online retail blossomed, in the process considerably boosting customer expectations in the online environment. This has raised the bar, forcing suppliers to relook at how they work in the digital space and make significant changes to keep up with user expectations. Many of suppliers’ mission-critical systems are decades old and don’t have the functionality or flexibility to keep up with today’s dynamic distribution environment. Though many were planning to redevelop these systems prior to the crisis, with most scarce on resources, partnering with travel intermediaries (GDSs, OTAs, TMCs or pure tech companies)to profit from their experience and ongoing investments is increasingly seen as an easier way to respond to pressing market needs. Such an approach represents a lower risk and comparatively cost-effective method of playing catch-up to gain access to the latest technologies, staying current with them and being able to satisfy the increasingly sophisticated needs of customers.

Cost effectiveness

Irrespective of whether supplementing existing systems or reaching out to additional consumer segments, partnering with online travel intermediaries is seen as cost effective in comparison with developing comparable functionality internally. Not only does it typically require little to no capital expenditure, but costs are typically linked to volume of business. For example, distributing through GDSs, TMCs and OTAs necessitates the payment of transaction fees or commissions respectively, but are pay-for-performance, with no bookings meaning no costs. In contrast, attempting to distribute directly incurs significant investment and marketing costs with little or no guarantee of success. Furthermore, online travel intermediaries can leverage their greater volume from amalgamating transactions from multiple suppliers to achieve substantial economies of scale. This results in lower transaction costs than can be achieved by working in isolation. On that account, partnering with online intermediaries is increasingly seen as better value than trying to go it alone.

Access to real-time, detailed, segment data

Since they service multiple suppliers and segments, online intermediaries can consolidate vast amounts of data in real time to generate market intelligence that can help suppliers plan and manage better. With historical data no longer as relevant due to COVID-19, such topical insights are perceived as a resource for creating operational efficiencies and providing valuable input into forecasting, capacity planning and revenue management.

However, working with online travel intermediaries does not come without some challenges. Travel is characterized by long standing historical relationships that often result in resistance to change. For example, while vacation rental providers have quickly gained access to what were once hotel-focused OTA channels, hotels have been slower to exploit the potential of vacation rental channels. This lag persists, despite efforts by the latter to encourage participation. Similarly, many suppliers struggle to understand the changing nature of their relationship with online travel intermediaries. Finding themselves simultaneously competing and cooperating with these third parties, many smaller players are struggling with this adjustment toward working in non-exclusive virtual alliances, leading to unnecessary conflict and lost opportunities. Larger suppliers, in contrast, seem more progressive and have embraced these new partnerships with enthusiasm. The lodging giants are squeezing as much value as possible out of these new symbiotic relationships, while simultaneously acknowledging that doing so makes it more difficult to differentiate in the long run.

With everyone using similar technology, no single company can pull away from the pack with their distribution efforts and offerings as easily. Suppliers must carefully balance the comparative advantages of partnering with online travel intermediaries – lower costs, faster time to market and reduced risk – with the need to find innovative ways to gain competitive advantage and differentiate themselves.

Conclusion

A key component of the travel value chain, the function and scope of online travel intermediaries has evolved over the past decade. Once seen solely as distribution channels, they now simultaneously collaborate and compete with travel suppliers for the customer dollar. Their role has become infinitely more sophisticated, allowing suppliers to selectively supplement their distribution efforts by targeting specific groups or segments on a highly efficient, pay-per-performance basis.

Most suppliers actively acknowledge the valuable contribution online travel intermediaries make to their distribution strategy today. This trend has been accelerated by the COVID-19 pandemic, with most suppliers trying to do more with less and reaching out to online travel intermediaries as trusted distribution partners with whom they can work to exploit opportunities.

However, the evolution does not stop there. Online travel intermediaries are changing, broadening their focus by integrating both backwards and forwards in their value chain, developing into comprehensive travel technology platforms rather than just distribution facilitators. There is already evidence of this shift. For example, GDSs are generating increased proportions of revenue from technology services rather than distribution fees. Similarly, many major OTAs are positioning themselves as technology platforms, selectively working with partner suppliers to enable functionality or features that would be difficult and costly for the latter to develop internally.

Driven by systemic changes arising from the COVID-19 crisis, travel distribution is entering a new phase, one where partnership is the name of the game. The most successful travel suppliers of this new era will be the ones who figure out how to best partner with the right portfolio of online travel intermediaries. In addition to gaining broader distribution, they will supplement their technological capacities and better serve their customers.

About Phocuswright

Phocuswright is the travel industry research authority on how travelers, suppliers and intermediaries connect. Independent, rigorous and unbiased, Phocuswright fosters smart strategic planning, tactical decision-making and organizational effectiveness.

To complement its primary research in North and Latin America, Europe and Asia, Phocuswright produces several high-profile conferences in the United States, Europe and Asia Pacific. Industry leaders and company analysts bring this intelligence tolife by debating issues, sharing ideas and defining the ever-evolving reality of travel commerce.

Phocuswright also operates PhocusWire, a media service that covers the world of digital travel 365 days a year with a range of news, analysis, commentary and opinion from across the travel, tourism and hospitality sector.

The company is headquartered in the United States with Europe and Asia Pacific operations and local analysts on five continents.

Phocuswright is a wholly owned subsidiary of Northstar Travel Group.

About Travel Tech

Travel Tech is the voice of the travel technology industry, advocating for public policy that promotes transparency and competition in the marketplace to encourage innovation and preserve consumer choice. We represent the leading innovators in travel technology including global distribution systems, online travel agencies, short- term rental platforms, metasearch platforms and travel management companies.